Data Loss Prevention Market Report 2025 | Size, Growth & Forecast by 2033

Market Overview:

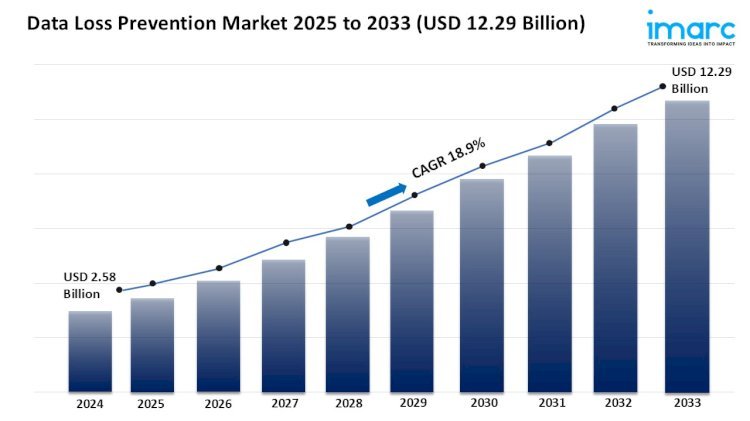

The data loss prevention market is experiencing rapid growth, driven by rising data breaches and cyber threats, stringent data privacy regulations, and cloud adoption and remote workforce expansion. According to IMARC Group's latest research publication, "Data Loss Prevention Market Size, Share, Trends and Forecast by Type, Services, Size, Deployment Type, Application, and Region, 2025-2033", the global data loss prevention market size was valued at USD 2.58 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.29 Billion by 2033, exhibiting a CAGR of 18.9% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/data-loss-prevention-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Data Loss Prevention Market

- Rising Data Breaches and Cyber Threats

The surge in cyberattacks and data breaches is a major factor pushing the growth of the data loss prevention (DLP) industry. As organizations face increasingly sophisticated threats, the average cost of a data breach has reached nearly USD 4.88 million, emphasizing the urgent need for robust data protection. DLP solutions help prevent sensitive information leaks, making them critical for businesses across sectors, especially with remote work setups expanding data access points. Companies adopting AI and automation in DLP save roughly USD 2.22 million per breach, highlighting the financial impact and importance of proactive security measures in today's digital landscape.

- Stringent Data Privacy Regulations

Government regulations like GDPR in Europe and CCPA in California have made data security mandatory for organizations handling personal and sensitive data. These laws impose strict penalties for non-compliance, motivating companies to invest heavily in DLP solutions. North America leads the market, holding over 29% share due to rigorous enforcement and advanced cybersecurity ecosystems. Such privacy laws compel businesses to implement comprehensive DLP tools to monitor, detect, and prevent unauthorized data transfers, ensuring compliance and averting costly legal risks. Regulatory pressures have thus become one of the most powerful growth drivers.

- Cloud Adoption and Remote Workforce Expansion

The widespread shift to cloud computing and the rise of remote work arrangements have significantly expanded the attack surface for data loss. Organizations now rely on cloud-based DLP solutions to protect sensitive data stored and accessed across hybrid and multi-cloud environments. With more mobile devices and endpoints connecting remotely, traditional perimeter defenses are no longer sufficient. This transition fuels demand for advanced, scalable DLP tools capable of centralized management, real-time monitoring, and enforcement of data security policies regardless of location, enabling organizations to maintain control in an increasingly distributed digital environment.

Key Trends in the Data Loss Prevention Market

- AI-Powered and Behavioral Analytics-Driven DLP

Data loss prevention platforms are increasingly integrating artificial intelligence and behavioral analytics to detect risk patterns beyond traditional rule-based methods. These solutions continuously learn from user actions and anomalies, improving the detection of insider threats and sophisticated cyberattacks. For example, AI-enhanced DLP can identify unusual data access or transfer behaviors that might indicate malicious intent or accidental breaches. This trend offers organizations dynamic, adaptive protection enabling faster, more accurate responses and reducing false positives, which optimizes security operations and resource use.

- Cloud-Centric Data Loss Prevention Solutions

With the rapid migration of workloads to public and private clouds, cloud-native DLP solutions have become essential. These provide seamless protection for data residing on cloud platforms like AWS, Azure, and Google Cloud. Organizations benefit from centralized policy management, scalability, and real-time visibility into data in use, in motion, and at rest across multiple cloud environments. For instance, firms using cloud-centric DLP can enforce encryption and block unauthorized transfers instantly, regardless of data location, addressing the unique challenges posed by multi-cloud ecosystems and remote access.

- Focus on Insider Threat Detection and Prevention

Insider threats caused by current or former employees, contractors, or business partners remain a significant risk to sensitive data. Modern DLP systems increasingly combine with insider threat detection tools that monitor user activities with advanced analytics to prevent data leakage from within the organization. For example, integration with user behavior analytics (UBA) platforms helps flag deviations from normal patterns that could signal deliberate or accidental data compromises. This focus reflects a broader industry shift towards holistic security frameworks emphasizing internal as well as external threat mitigation.

The data loss prevention market report provides a comprehensive overview of the industry. This analysis is essential for stakeholders aiming to navigate the complexities of the biochar market and capitalize on emerging opportunities.

Leading Companies Operating in the Data Loss Prevention Industry:

- Absolute Software Corporation

- Broadcom Inc.

- Cisco Systems Inc.

- Digital Guardian (HelpSystems LLC)

- Forcepoint

- Gtb Technologies Inc.

- McAfee Corp.

- Proofpoint Inc.

- Thales Group

- Trend Micro Inc.

- Trustwave Holdings (Singapore Telecommunications Limited)

- Zecurion

Data Loss Prevention Market Report Segmentation:

By Type:

- Data Center DLP

- Endpoint DLP

- Network DLP

Network DLP systems enable session-level traffic analysis and enforce security standards by monitoring and managing data across various network channels.

By Services:

- Managed Security Services

- Training and Education

- Consulting

- System Integration and Installation

- Threat and Risk Assessment

Managed security services offer ongoing monitoring and protection of sensitive data, helping organizations comply with regulations and manage security challenges effectively.

By Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises hold a 56.7% market share in 2024, utilizing DLP to manage complex data ecosystems and enforce data protection policies.

By Deployment Type:

- On-premises

- Cloud Data Loss Protection

On-premises DLP solutions dominate with 56.0% market share in 2024, providing organizations greater control and customization over sensitive data management.

By Application:

- Cloud Storage

- Encryption

- Policy Standards and Procedures

- Web and Email Protection

- Others

Encryption leads the DLP market with a 20.6% share in 2024, safeguarding data by converting it into unreadable formats to ensure confidentiality and compliance.

By Industry:

- Healthcare

- Retail and Logistics

- Defense and Intelligence

- Public Utilities and Government Bodies

- BFSI

- IT and Telecom

- Others

IT and telecom sectors lead the market with 19.5% share in 2024, driven by increasing data breaches and the need for stringent data loss prevention measures.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America accounts for 29.8% of the DLP market in 2024, driven by cloud adoption and new regulations enhancing data handling transparency.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

What's Your Reaction?