Macroeconomic Connections: How CoinMinutes Links Traditional and Crypto Markets

Macroeconomic Connections: How CoinMinutes Links Traditional and Crypto Markets

Remember when Bitcoin seemed completely separate from the stock market? Those days are gone.

Now when the Federal Reserve announces higher interest rates, Bitcoin often drops like a rock. When inflation numbers come out higher than expected, crypto markets freak out just like regular markets do.

This isn't just a feeling – it's backed by real data. A 2023 study found that regular economic announcements now cause about 27% of Bitcoin's price movements. Back in 2017, that number was tiny – just 3%. That's a massive change in how crypto behaves.

At CoinMinutes, we spotted this trend early. We've seen countless examples of economic news triggering immediate crypto market reactions. Like when the jobs report came out stronger than expected last year, and Bitcoin dropped 3% in minutes. Five years ago, crypto traders would've barely noticed that report.

What Are Macroeconomic Factors?

Macroeconomic factors are just big-picture economic stuff that affects entire markets. You can picture them as the economic weather that affects all your investments, not only the specific ones.

These are the most significant ones you should know about:

Inflation: This is the process where the prices of goods and services rise in general. When over the past year a gallon of milk that cost $3 has come to cost $3.30, that's inflation. Usually, high inflation leads central banks to increase interest rates which, in general, pull the investment prices down. The government measures that by something called the Consumer Price Index (CPI).

Interest Rates: This is the amount of money that you have to pay in order to borrow money. When rates go up, loans become more expensive, and there is less money that is available for investing. When rates drop, the opposite happens. You can compare interest rates to a faucet that controls the amount of money that flows through the economy.

GDP Growth: This is a measure of whether the economy is expanding or contracting. Usually, as a result of strong growth, investments do well. On the other hand, slow or negative growth almost always leads to a heavy investment environment.

Monetary Policy: These are the decisions of central banks to either help or control the economy. Normally, when they do quantitative easing, the prices of the market go up. On the contrary, if they are very strict, the prices will drop.

Jobs Data: Reports on how many people are working. Strong job numbers are usually a signal of a vigorous economy but, at the same time, they might make the people fear inflation.

World Events: Serious conflicts, trade disagreements, or political unrest are just a few of the things that can cause market instability anywhere in the world.

We at CoinMinutes crypto are constantly monitoring all these factors with our Macro Monitor dashboard. We have identified a very interesting aspect: the price of Bitcoin is currently changing in a way that is more similar to traditional markets when economic news is released. This relationship has been going stronger throughout the year 2023, with a new record of 0.72 (where 1 would indicate an identical behavior).

Traditional vs. Crypto Markets: Key Similarities and Differences

These markets are connected to each other through a network of similarities and differences. Going by these factors, is much easier to understand the connection between the two markets.

How They're Similar

Money Flow Matters: Both markets are sensitive to changes in the availability of money. For instance, when interest rates go up and loans become expensive, usually both stock and crypto prices decrease.

Fear and Greed: Both are influenced by the sentiments of investors in terms of taking risk. For example, when the economy is in trouble and people are afraid, they do not put money in risky investments.

Big Players: The arrival of big investment firms in the crypto market means that traditional market behaviors are now part of the crypto market. Such companies usually behave in the same way when dealing with all their investments.

Chart Patterns: Most of the same technical patterns are applicable in both markets as they represent traders' (and computers') behavior when trading.

How They're Different

Always Open: Local market shutdowns take place in the evening and weekends. However, crypto is a 24-hour a day, 7-day a week trader and is therefore in constant operation worldwide, so it can respond to any international news at any time.

Extreme Price Fluctuations: The difference between cryptocurrency and stock is that the price of the first jumps around a lot more. In 2023, the daily average of Bitcoin price was changed by 3.2%, while the daily average of the stocks that make up the S&P 500 index was just 1.1%.

Rules and Regulations: For a long time, traditional markets have had stable and well-established regulations. On the other side, crypto rules differ from country to country and are still under the process of being figured out.

Market Age: Conventional markets have established and consistent valuation standards and have been around for decades. With the advent of crypto, the valuation aspect is still tricky, and the history is much shorter.

What They're For: Most of the time, the digits underpinning technologies in cryptocurrencies are the same ones that make them successful investments. This fact alone leads to a phenomenon peculiar to the crypto market – a unique way to behave.

One can see such interesting influences found by the CoinMinutes between these markets. For example, if an event such as the stock market falling on a Monday had occurred, we would probably say that Bitcoin was the one that didn't get influenced, remaining steady. However, we could then observe Bitcoin weakening at about 3 AM on Tuesday to become in line with the stock market's move. The revelation was that they were connected but not simultaneous.

The CoinMinutes Cross-Market Correlation Matrix, one of our daily updated platforms where these relationships are dematerialized, is where we can see how traditional and crypto markets are moving together or apart.

Traditional market and crypto market are interconnected

How CoinMinutes Connects the Dots

At CoinMinutes, we help investors understand how economic news affects crypto in several ways:

Looking at Real Connections in Data

We track how economic announcements and crypto prices have moved together in the past. Our research shows:

- When real interest rates go up, Bitcoin tends to go down (they have a -0.63 correlation, which is pretty strong)

- When the NASDAQ tech stock index does well, Ethereum often does too (0.58 correlation)

- Smaller cryptos tend to follow traditional risky investments even more closely during market stress

Knowing these patterns helps predict how cryptocurrencies might respond to upcoming economic news.

Making Sense of Market News

When big economic news breaks, we explain:

- What the economic data actually means in plain English

- How crypto responded to similar news in the past

- Whether the news was better or worse than people expected

- Which cryptocurrencies are most affected by this specific type of news

This helps our users understand not just what happened, but why it matters for their crypto investments.

One of our subscribers told us that our explanation of last October's inflation report helped him understand why Bitcoin jumped 5% that day. We explained that lower inflation meant the Fed might ease up on interest rates, which is typically good for Bitcoin. He said that context was much more helpful than just seeing price charts.

Looking at Different Time Periods

We recognize that economic news affects markets differently over various time periods:

- Short-term (hours to days): The immediate reaction, often based on emotion and trading algorithms.

- Medium-term (weeks to months): The secondary effects as investors move money between different types of investments.

- Long-term (months to years): The bigger shifts in how people invest as economic trends become established.

Our analysis separates these timeframes, helping you tell the difference between temporary reactions and fundamental shifts.

Expert Insights from Both Worlds

At CoinMinutes, we work with experts from both traditional finance and crypto. This diverse group provides unique insights into how economic thinking applies to crypto assets.

A recent survey of our experts found that 83% believe the connection between economic factors and crypto performance will keep getting stronger through 2025 and beyond.

Tools & Resources for Beginners

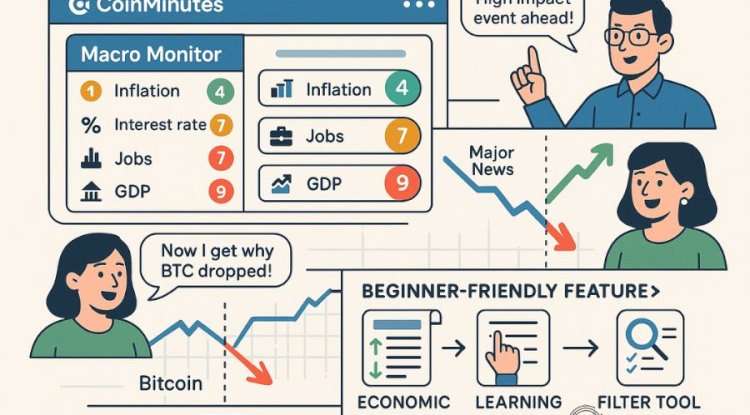

You don't need an economics degree to understand these connections. At CoinMinutes, we offer several beginner-friendly tools:

Economic Calendar with Crypto Impact Scores

Our calendar highlights upcoming economic events with:

- Scores showing how much each event typically affects crypto (on a 1-10 scale)

- Expected numbers versus previous ones

- Simple explanations of what each economic indicator means

- Typical market reactions to watch for

This helps you focus on the economic news that actually matters for crypto.

Maria, a new subscriber, told us: "I've started checking your calendar every Sunday night to prepare for the week ahead. Last month, it flagged an upcoming Fed speech as 'high impact' when most crypto sites didn't even mention it. The speech caused a 7% Bitcoin move, and I was prepared thanks to your heads-up."

Seeing Connections on Charts

Our interactive tool shows:

- How major cryptocurrencies and traditional market indicators move together

- How these relationships change during different market conditions

- Which cryptocurrencies react most strongly to specific economic factors

You can filter by time period and market conditions to see how relationships evolve.

CoinMinutes provides tools and resources for understanding economic impacts on crypto

Learning About Economics for Crypto

For beginners, we offer step-by-step learning that covers:

- Basic economic concepts and why they matter for crypto

- How to understand key economic reports

- What to listen for when central banks make announcements

- How economic cycles affect different cryptocurrencies

This helps bridge the knowledge gap between traditional finance and cryptocurrency markets.

Weekly Report on Market Connections

Our regular update highlights:

- Important economic developments from the past week

- How crypto markets responded compared to expectations

- Upcoming economic events and their potential impact

- Changes in connection patterns worth noting

The report uses clear language and visual explanations that beginners can understand.

Useful Reference: https://www.facebook.com/coinminutescrypto/

Conclusion

The wall between traditional finance and cryptocurrency markets is coming down. Economic factors that once seemed irrelevant to crypto now drive major price movements. Understanding these connections has become crucial for anyone investing in crypto.

At CoinMinutes, we've built a bridge between these worlds, with tools and analysis that help people navigate this increasingly connected landscape. We combine data-driven insights with simple explanations, making economic relationships understandable for crypto investors of all experience levels.

As big institutions keep entering crypto and regulations develop, these connections will likely get even stronger. Investors who understand how traditional economic factors influence crypto markets gain a big advantage in anticipating market movements.

The future of crypto investing isn't about ignoring traditional finance—it's about understanding how these markets affect each other in an increasingly connected global financial system. That's why we'll continue developing better tools to help you navigate these connections.

Find More Information: How CoinMinutes Helps You Navigate the Changing Cryptocurrency Ecosystem

What's Your Reaction?