Transforming Business Efficiency with Payroll Management Software

In today’s competitive business environment, companies are constantly searching for smarter ways to simplify operations while boosting accuracy and compliance. One of the most crucial areas where efficiency matters is payroll management. Handling salaries, deductions, compliance, and employee benefits manually can be overwhelming, time-consuming, and prone to errors. This is where Payroll Management Software steps in as a powerful solution.

Modern payroll service software not only automates salary calculations but also integrates seamlessly with HR functions, ensuring a streamlined, error-free, and transparent process. For businesses in India and worldwide, adopting the best payroll software has become less of an option and more of a necessity.

What is Payroll Management Software?

Payroll management software is a digital tool designed to automate payroll processing tasks such as employee salary calculations, tax deductions, compliance management, direct deposits, and record-keeping. It eliminates the burden of manual calculations while ensuring accuracy, consistency, and compliance with statutory requirements.

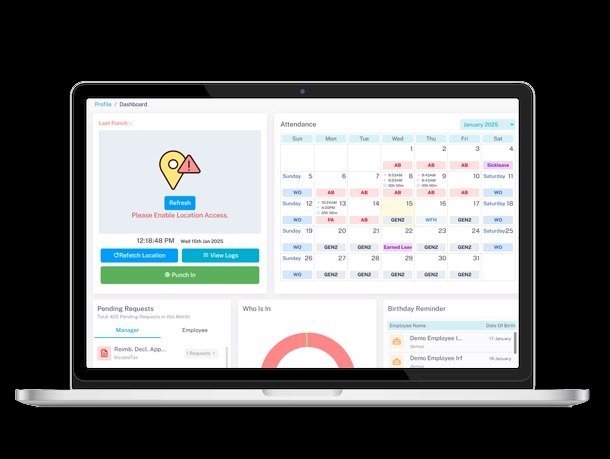

Unlike traditional manual systems, payroll software integrates with attendance, leave, and performance tracking, giving HR departments a unified platform to manage workforce-related data effectively.

Key Features of Payroll Service Software

-

Automated Salary Processing – Quickly calculate gross pay, deductions, and net pay without manual intervention.

-

Tax and Compliance Management – Stay updated with statutory regulations such as PF, ESIC, TDS, and professional tax.

-

Integration with HR Systems – Sync with attendance, leave, and performance systems for accurate payroll runs.

-

Direct Bank Transfers – Ensure timely salary disbursement directly to employees’ bank accounts.

-

Customizable Reports – Generate detailed payroll and compliance reports in just a few clicks.

Why Businesses Need the Best Payroll Software

Every business, regardless of size, needs to ensure that payroll is handled with accuracy, confidentiality, and efficiency. Delayed or incorrect salaries can lead to employee dissatisfaction, compliance risks, and even reputational damage. The best payroll software solves these challenges by offering:

1. Accuracy and Transparency

With automation, errors in salary calculations are minimized. Employees can also access payslips and tax information online, improving trust and transparency.

2. Compliance Made Easy

Indian businesses face multiple statutory obligations. Payroll service software ensures compliance with PF, ESIC, gratuity, and tax regulations without the HR team having to worry about constant updates.

3. Time and Cost Savings

By automating payroll, businesses save hours of manual work, freeing up HR teams to focus on employee engagement and strategic initiatives.

4. Data Security

Payroll involves sensitive employee data. The best payroll software comes with advanced security measures such as encryption, role-based access, and secure storage, ensuring complete confidentiality.

Payroll Management Software in India: Rising Adoption

With India’s growing workforce and increasing regulatory demands, more organizations are embracing payroll management software to simplify HR operations. From startups to large enterprises, businesses across sectors are realizing the importance of integrating payroll automation into their operations.

Why Indian Businesses Prefer Payroll Software

-

Regulatory Landscape – Frequent changes in tax laws and labor regulations make compliance challenging without automation.

-

Workforce Size – India has a diverse and rapidly expanding workforce, requiring scalable payroll solutions.

-

Cost-Effectiveness – Cloud-based payroll service software offers affordable solutions for businesses of all sizes.

Choosing the Best Payroll Software for Your Business

Not all payroll systems are created equal. The right software should align with your business size, industry, and compliance requirements.

Factors to Consider When Selecting Payroll Service Software

-

Ease of Use – User-friendly dashboards that HR teams and employees can easily navigate.

-

Scalability – Ability to handle growing employee numbers as the company expands.

-

Integration Capabilities – Seamless integration with existing HR and accounting systems.

-

Customization – Flexibility to adapt to specific business needs.

-

Support and Updates – Dedicated customer support and regular updates to meet evolving compliance standards.

Cloud-Based Payroll Service Software: The Future of HR

One of the biggest transformations in payroll technology is the shift toward cloud-based payroll management software. With cloud solutions, businesses enjoy:

-

Accessibility Anytime, Anywhere – HR teams can process payroll from any location.

-

Real-Time Updates – Instant access to compliance changes and salary adjustments.

-

Reduced IT Costs – No need for heavy infrastructure investment; everything runs on secure cloud servers.

-

Employee Self-Service Portals – Employees can download payslips, update personal information, and apply for leave without HR intervention.

Payroll Service Software and Employee Experience

Payroll is not just about numbers—it directly impacts employee satisfaction. Delays or errors in payroll create mistrust and dissatisfaction. On the other hand, using the best payroll software ensures:

-

On-Time Salaries – Boosting employee morale and trust.

-

Transparent Records – Employees can access their payslips, tax details, and benefits anytime.

-

Reduced Disputes – Automated accuracy means fewer payroll disputes and grievances.

Benefits of Payroll Management Software for Small, Medium, and Large Businesses

1. For Small Businesses

Small businesses often struggle with limited HR resources. Payroll management software helps them handle payroll without hiring a large team.

2. For Medium Enterprises

As businesses grow, compliance and reporting become complex. Payroll service software simplifies these tasks, ensuring smooth operations.

3. For Large Enterprises

Large corporations deal with massive employee data. The best payroll software offers scalability, integration, and security to handle such vast operations efficiently.

Why SGC Management Services Pvt. Ltd. Offers the Right Payroll Solutions

At SGC Management Services Pvt. Ltd., we understand the challenges businesses face when managing payroll. Our advanced payroll service software is designed to deliver efficiency, compliance, and ease of use. We combine technology with expertise to offer end-to-end payroll solutions tailored to Indian businesses.

Our payroll service software helps businesses:

-

Automate complex payroll processes.

-

Stay compliant with Indian tax and labor laws.

-

Improve employee satisfaction with transparency.

-

Scale operations as your workforce grows.

Final Thoughts

The shift toward digital transformation in HR is undeniable, and payroll management software is at the heart of this change. By choosing the best payroll software, businesses can ensure compliance, save costs, and create a positive employee experience.

What's Your Reaction?